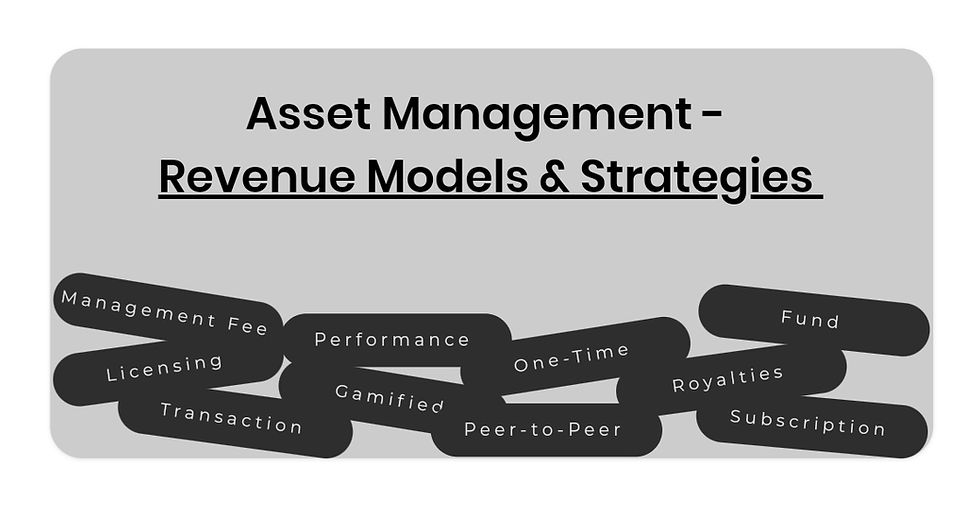

Asset management firms often rely on traditional revenue models, such as fee-based advisory services and portfolio management. This article will delve into these approaches while highlighting unique strategies, like AI-driven investment tools or subscription-based financial planning, adopted by leading firms and startups. By analyzing revenue models from adjacent industries, like banking or fintech, we’ll uncover fresh ideas for innovation. Key metrics—like assets under management, client retention rates, and fee structures—will be discussed for creating sustainable revenue streams.

INDEX

Comprehensive List of All Standard Revenue Models of Asset Management Business

1. Management Fees Based on Assets Under Management (AUM)

What it is: Investment managers charge a fee based on the total assets they manage for their clients. Typically, this is a percentage of the AUM.

Top Companies & Startups:

BlackRock: A leading global asset manager that charges management fees based on the value of assets under management across its funds.

Vanguard: Offers investment funds and ETFs, collecting management fees based on the assets in the funds.

Fidelity: Charges management fees for its various managed portfolios based on the assets in the portfolio.

Benefits/Disadvantages:

Benefits: Recurring, predictable revenue as long as the assets are maintained or grow.

Disadvantages: Revenue is directly tied to asset performance; a decrease in AUM results in lower fees.

Execution: Asset managers must regularly monitor portfolios and maintain relationships with clients to ensure assets stay invested and grow.

Practical Example: An asset management firm manages $100 million in assets, charging a 1% annual fee. The firm earns $1 million in management fees annually.

2. Performance-Based Fees Tied to Investment Returns

What it is: Asset managers charge a fee that is contingent on the performance of the investments they manage, typically a percentage of the returns generated above a benchmark or hurdle rate.

Top Companies & Startups:

Two Sigma: A quantitative hedge fund that charges performance-based fees.

Bridgewater Associates: One of the largest hedge funds in the world, with performance-based fees on returns over specific benchmarks.

Elliott Management: A global hedge fund that incorporates performance-based fees in its compensation structure.

Benefits/Disadvantages:

Benefits: Aligns interests with clients; if returns are high, so are fees.

Disadvantages: Fees can fluctuate significantly depending on market conditions; clients may be hesitant if they believe the performance fee structure is too high.

Execution: Performance metrics and benchmarks must be clearly defined in contracts, and a percentage of the positive return is calculated as the fee.

Practical Example: A fund earns a 15% return on $10 million invested. If the performance fee is 20%, the asset manager receives $300,000 as a performance fee.

3. Subscription-Based Advisory Services for Individual Investors

What it is: Offering financial advisory services for a recurring subscription fee, often on a monthly or yearly basis.

Top Companies & Startups:

Betterment: A robo-advisor offering subscription-based advisory services with automated investing and personalized advice.

Wealthfront: Another robo-advisor providing personalized financial planning on a subscription model.

Personal Capital: Provides financial advisory services for a subscription fee, including tools to track assets and liabilities.

Benefits/Disadvantages:

Benefits: Predictable, recurring income with lower barriers to entry for individual investors.

Disadvantages: Could be harder to scale as subscription services depend on consistent customer retention.

Execution: Market the advisory service and ensure continuous value through regular updates, investment strategies, or new offerings.

Practical Example: An advisory service charges $200 per month for subscriptions, with 100 clients. The firm generates $20,000 per month in revenue.

4. One-Time Consultation or Planning Fees

What it is: Charging clients a one-time fee for a specific consultation or financial plan.

Top Companies & Startups:

Charles Schwab: Offers one-time consultations and financial planning services for clients on an as-needed basis.

NerdWallet: Provides one-time consultations for people seeking specific financial advice.

SmartAsset: Offers fee-for-service financial planning.

Benefits/Disadvantages:

Benefits: Large one-time revenue boosts and flexible pricing based on service complexity.

Disadvantages: Unpredictable income and potentially fewer recurring clients.

Execution: Market the one-time service to individuals who need advice on specific issues, such as retirement planning or investment strategy.

Practical Example: A one-time consultation for $500 per client, with 20 consultations a month, yields $10,000 monthly revenue.

5. Retainer Fees for Ongoing Financial Planning Services

What it is: Charging a flat monthly or annual fee for continuous financial planning services, providing clients with regular financial updates and advice.

Top Companies & Startups:

XY Planning Network: A group of financial planners that charge monthly retainer fees for ongoing services.

Facet Wealth: A financial planning firm offering retainer-based services with a monthly fee structure.

Abacus Wealth Partners: Provides ongoing retainer-based financial advice for clients, ensuring long-term relationships.

Benefits/Disadvantages:

Benefits: Stable and recurring revenue; long-term client relationships.

Disadvantages: Can be hard to scale or attract clients willing to commit to ongoing fees.

Execution: Maintain regular client meetings and offer continuous financial planning support, ensuring clients receive ongoing value.

Practical Example: A financial planner charges $200 per month, with 50 clients. The firm generates $10,000 in retainer fees per month.

6. Revenue Sharing from Partnered Investment Platforms or Funds

What it is: Receiving a percentage of the revenue generated by clients investing through a partnered platform or fund.

Top Companies & Startups:

Acorns: A micro-investing platform that partners with other financial service providers, sharing revenue from investments.

Stash: A platform that allows users to invest, while sharing a percentage of revenue with partners offering financial tools.

Benefits/Disadvantages:

Benefits: Low operational costs and access to new client bases via partnerships.

Disadvantages: Dependency on partner success and client activity; partnerships need to be carefully managed.

Execution: Create partnerships with investment platforms or funds, and set up agreements for revenue sharing.

Practical Example: An investment platform shares 5% of its revenue from investor transactions with a financial advisor, generating $50,000 in fees from $1 million in investments.

7. Licensing Proprietary Investment Tools or Models

What it is: Charging fees for licensing proprietary investment strategies, models, or software to other financial institutions or advisors.

Top Companies & Startups:

Morningstar: Offers investment research tools and data models for licensing.

QuantConnect: Provides algorithmic trading tools that are licensed to other financial institutions.

Benefits/Disadvantages:

Benefits: High margins on licensing, potential for large-scale revenue if the model is in demand.

Disadvantages: Requires significant investment in technology and intellectual property.

Execution: Develop unique, proprietary investment tools or software, and license them to other financial firms.

Practical Example: A proprietary algorithm for financial forecasting is licensed to investment firms for a yearly fee of $100,000, generating steady annual revenue.

8. Revenue from Managed Accounts or Fund Structures

What it is: Earning fees by managing a client’s portfolio in a specific fund structure, with profits shared between the firm and the client.

Top Companies & Startups:

J.P. Morgan Asset Management: Manages various fund structures and earns revenue from the assets within those funds.

T. Rowe Price: Manages mutual funds and charges management fees for overseeing the funds.

Benefits/Disadvantages:

Benefits: Recurring revenue from ongoing fund management.

Disadvantages: Dependent on fund performance and market conditions.

Execution: Create diverse fund structures and offer them to investors, with ongoing management fees based on the funds’ size.

Practical Example: A firm manages a $50 million fund and charges a 1% annual fee, generating $500,000 in annual revenue.

9. Transaction Fees for Asset Buying, Selling, or Rebalancing

What it is: Charging a fee for each asset transaction made by clients, including buying, selling, or rebalancing their portfolios.

Top Companies & Startups:

TD Ameritrade: Charges transaction fees for asset purchases, sales, and rebalancing.

Robinhood: Charges small fees for more complex trades or rebalancing options.

Benefits/Disadvantages:

Benefits: Instant revenue generation per transaction.

Disadvantages: Revenue may be inconsistent and reliant on client activity.

Execution: Implement a clear, transparent fee structure for clients on all transactions related to their portfolio.

Practical Example: A firm charges $10 per transaction, with 1,000 transactions per month, generating $10,000 in monthly revenue.

10. Educational Revenue from Financial Literacy Courses or Webinars

What it is: Earning money by offering educational content, such as courses or webinars, to individuals seeking financial education.

Top Companies & Startups:

Udemy: Offers a variety of financial literacy courses for a fee.

Khan Academy: Provides free and paid financial education resources, generating revenue from premium offerings.

Benefits/Disadvantages:

Benefits: A scalable revenue model with a broad market for educational content.

Disadvantages: Requires investment in course development and marketing to attract paying customers.

Execution: Develop courses or webinars on financial topics, and charge fees for access to the content.

Practical Example: A financial advisor offers a 6-week course for $200, with 500 participants. The advisor generates $100,000 in revenue.

Unique Revenue Models of Asset Management Business as adopted by Top Brands and Start Ups

1. Robo-Advisory Platforms with Subscription or Freemium Tiers

What it is: Robo-advisory platforms use algorithms to provide automated financial advice or portfolio management, often offered with a subscription or freemium model. Basic services are provided for free, while premium services with more advanced features, higher customization, or additional investment strategies are available through a subscription fee.

Top Companies & Startups:

Betterment: A leading robo-advisor that offers a freemium model where users can access basic investment advice for free, and pay a subscription for advanced planning features.

Wealthfront: Offers automated investment management with a tiered pricing model that includes a free version and premium access to financial planning tools.

Acorns: Offers a subscription-based robo-advisory service that invests spare change for users, with premium features like investment advice and retirement planning.

Benefits/Disadvantages:

Benefits:

Provides affordable access to professional-level investment advice.

Scalable model that serves both small and large investors.

Automated services lower operational costs.

Disadvantages:

Limited human interaction may not suit all investors.

Premium features may alienate lower-income or beginner investors.

Execution:

Provide basic services for free or at a low cost (e.g., portfolio balancing).

Offer premium, personalized financial strategies or tax optimization tools as part of a paid subscription.

Practical Example:

A user subscribes to Betterment’s premium plan for $299/year. In return, they receive personalized tax optimization strategies, which lead to a tax savings of $3,000 annually. The platform charges a small fee (around 0.25% of assets managed).

2. AI-Driven Investment Analytics with Premium Pricing for High-End Tools

What it is: AI-driven platforms offer advanced tools for portfolio analysis, trend forecasting, and risk management using machine learning and artificial intelligence. These services are typically available at a premium price for high-end tools or specific industry insights.

Top Companies & Startups:

Kavout: Provides AI-powered investment analytics tools for institutional and retail investors, offering premium services like advanced trend forecasting models.

Upstox: Integrates AI-driven insights and data analytics to enhance retail investment decisions, with premium features offered for advanced trading tools.

Zacks Investment Research: Offers AI tools to analyze market data and trends with a subscription model for professional-grade insights.

Benefits/Disadvantages:

Benefits:

Provides users with sophisticated and automated investment tools.

Helps in making data-driven decisions with advanced predictive capabilities.

Disadvantages:

Expensive premium offerings may not be accessible for all investors.

Algorithmic predictions may fail during market anomalies, causing trust issues.

Execution:

Use AI to collect and analyze market data, providing insights into asset performance, trends, and potential risks.

Offer these tools at various subscription levels based on the complexity and depth of analysis.

Practical Example:

Kavout charges $500/month for premium access to its AI-driven portfolio optimizer, which provides users with personalized investment recommendations and performance analysis.

3. Gamified Investing Platforms with Revenue from In-App Purchases

What it is: Gamified investing platforms allow users to engage with investments through a game-like interface, encouraging learning and participation. Revenue is generated from in-app purchases, such as advanced tutorials, virtual currency for investment simulations, or premium content.

Top Companies & Startups:

Robinhood: Known for its gamified interface where users can "trade" stocks in a playful, easy-to-use app. Revenue comes from in-app purchases, such as premium memberships and features.

Stockpile: An app where users can buy fractional shares of stock as gift cards, with gamified features that encourage users to engage with stock market content.

Benefits/Disadvantages:

Benefits:

Attracts younger or new investors who prefer engaging, non-traditional platforms.

Encourages learning through fun, interactive experiences.

Disadvantages:

The gamification approach might encourage impulsive or uneducated investing decisions.

Investors may not take the process seriously and fail to recognize risks.

Execution:

Design the platform with gaming elements like rewards, challenges, and badges for achieving investment goals.

Include in-app purchases for premium features such as in-depth tutorials, customized stock analysis, or higher-leverage options.

Practical Example:

Robinhood generates revenue from its premium service, Robinhood Gold, at $5/month. Users get features like margin trading, advanced charting, and after-hours trading access.

4. Revenue Sharing from ESG-Focused Investment Funds

What it is: ESG (Environmental, Social, Governance)-focused investment funds attract investors looking to support sustainable and ethical companies. The platform generates revenue by sharing a percentage of management or performance fees with investors who support the fund.

Top Companies & Startups:

BlackRock: Offers a variety of ESG-focused investment funds, sharing a portion of the fund’s earnings or management fees with investors.

Betterment: Their Socially Responsible Investing (SRI) portfolios provide a way for users to invest based on ESG factors, generating revenue through management fees.

Benefits/Disadvantages:

Benefits:

Aligns investors’ financial goals with social and environmental impact.

The growing demand for ethical investments can provide strong long-term growth.

Disadvantages:

ESG funds may underperform traditional funds in some cases due to niche focus.

Limited options may prevent diversification within ESG portfolios.

Execution:

Create investment portfolios that prioritize companies or assets that align with ESG criteria.

Charge management fees on the funds or share a percentage of profits for investors who invest in these funds.

Practical Example:

Betterment’s SRI Portfolio charges 0.25% annually. If a user has $100,000 in their portfolio, the management fee would be $250 annually.

5. Tokenized Asset Management Platforms with Blockchain Integration

What it is: Tokenized asset management platforms allow users to buy shares of real-world assets (like real estate, gold, or art) through blockchain tokens. This offers increased liquidity and fractional ownership, which can be bought and sold quickly.

Top Companies & Startups:

RealT: A real estate tokenization platform that allows fractional ownership of real estate through blockchain-based tokens.

Securitize: Specializes in tokenizing private securities, including real estate, through its blockchain-based platform.

Benefits/Disadvantages:

Benefits:

Increased liquidity for traditionally illiquid assets.

Fractional ownership allows more investors to participate with lower capital.

Disadvantages:

Regulatory uncertainty around tokenization.

Market adoption can be slow, as investors may be wary of blockchain-based solutions.

Execution:

Issue blockchain-based tokens that represent fractional ownership of an underlying asset.

Charge fees for token issuance, transactions, or management of the underlying asset.

Practical Example:

RealT allows users to buy a token representing 1% of a rental property for $500. If the property generates $1,000/month in rent, each token owner receives $10/month in passive income.

6. Dynamic Pricing Models Based on Portfolio Complexity or Performance

What it is: Dynamic pricing models adjust the fees based on the complexity of a client’s investment portfolio or its performance. Higher complexity or higher-performing portfolios can attract higher fees.

Top Companies & Startups:

Charles Schwab: Uses dynamic pricing in certain portfolios by charging fees based on the size and complexity of the investments.

Wealthfront: Adjusts its pricing based on the user’s portfolio, with higher-tier pricing for higher-performing portfolios.

Benefits/Disadvantages:

Benefits:

Offers customized pricing that can align better with the client’s needs.

Attracts higher-net-worth clients who need more complex strategies.

Disadvantages:

Complexity in pricing could confuse users and lead to dissatisfaction.

May not be as attractive to smaller investors with simpler needs.

Execution:

Create different service tiers or customized pricing based on portfolio performance or complexity.

Charge clients based on these tiers for advanced strategies, real-time analysis, or higher-touch services.

Practical Example:

Charles Schwab may charge 0.5% for portfolios under $250,000 and increase to 1% for portfolios over $1,000,000, based on the need for advanced tax optimization.

A look at Revenue Models from Similar Business for fresh ideas for your Asset Management Business

1. Crowdfunding for Collective Investment Pools (Real Estate or Venture Capital Industry)

What it is:

Crowdfunding for collective investment pools involves raising capital from multiple investors to fund large-scale investments, such as real estate projects or venture capital opportunities. In this model, individuals can contribute relatively small amounts of money to participate in larger investment opportunities, which would typically be out of reach for individual investors. The funds are pooled together to invest in various assets, and profits are shared among the participants.

Top Companies & Startups Adopting This Model:

Fundrise: A real estate crowdfunding platform that allows individuals to invest in real estate projects by pooling their money together. It offers both accredited and non-accredited investors the opportunity to participate in real estate investments.

CrowdStreet: A platform that connects individual investors with commercial real estate projects. Investors can join real estate syndicates and invest in diverse real estate opportunities.

AngelList: Initially focused on venture capital, AngelList offers crowdfunding for startups. Investors contribute small amounts to a fund, which is then used to back early-stage companies.

Benefits/Disadvantages:

Benefits:

Democratizes investment opportunities by allowing smaller investors to pool funds for larger investments.

Diversification opportunities for investors in various types of assets (real estate, startups).

Potentially high returns on investments, especially in high-growth sectors.

Disadvantages:

High risk as investors may face potential losses if investments do not perform well.

Limited liquidity, as these types of investments may take years to yield returns.

Regulatory challenges, especially in jurisdictions with strict securities laws.

Execution:

Create an online platform where individuals can sign up to participate in crowdfunding pools.

Present detailed investment opportunities (e.g., real estate properties, startups) with expected returns, risks, and timelines.

Pool funds and distribute investments to the chosen assets.

Share profits and provide transparent reporting to investors on their returns.

Practical Example:

Fundrise Crowdfunding: If Fundrise raises $10 million from 1,000 investors who each contribute $10,000, they can invest in a portfolio of real estate properties. After 5 years, if the portfolio generates a 15% annual return, the investors collectively earn $7.5 million in profit. This would be distributed among the investors proportionally to their contributions.

2. Pay-Per-Use Access to Advanced Data Analytics (Tech Industry)

What it is:

In this model, companies offer access to advanced data analytics tools and platforms on a pay-per-use basis. Rather than requiring a full subscription or upfront purchase, clients pay for each instance or usage of the analytics service. This is ideal for businesses that require data-driven insights sporadically or for specific projects but do not want to commit to long-term contracts or licenses.

Top Companies & Startups Adopting This Model:

Tableau: A leading data analytics company offering both subscription-based services and pay-per-use options for its visualization tools, particularly for businesses that require advanced reporting on demand.

Google Cloud (BigQuery): Google Cloud provides pay-per-use access to BigQuery, its powerful data analytics service, where customers only pay for the amount of data they query, making it a cost-effective model for ad-hoc use.

AWS (Amazon Web Services): AWS offers various pay-per-use services for data analytics, including Amazon Redshift for data warehousing and Amazon Athena for querying large datasets.

Benefits/Disadvantages:

Benefits:

Flexible pricing model that allows businesses to only pay for the analytics they actually use.

Cost-effective for small or seasonal users who don’t need continuous access to advanced data analytics tools.

Scalable for enterprises, allowing them to adjust usage based on demand.

Disadvantages:

High costs for frequent or intensive data queries, which may become expensive in large-scale projects.

Complexity in pricing, which can be difficult for customers to predict.

Limited access to premium features unless customers commit to a higher-tier subscription.

Execution:

Offer access to a suite of analytics tools or platforms through cloud-based systems.

Charge customers based on usage, typically measured by data volume, compute power, or the number of queries executed.

Provide detailed pricing calculators to help customers estimate their costs.

Implement flexible billing systems that allow for periodic or per-use payments.

Practical Example:

Google BigQuery: If a company queries 1 TB of data in BigQuery, they might be charged $5 per TB. If the company runs 10 queries totaling 5 TB, their total bill for that period would be $25.

3. Licensing Data-Driven Financial Insights to Third Parties (Consulting Industry)

What it is:

This model involves generating valuable financial insights through data analysis and then licensing those insights to third parties. Companies or consultants analyze financial markets, company performance, or consumer behavior and package these insights into reports, forecasts, or tools that other businesses can license and use for their decision-making processes.

Top Companies & Startups Adopting This Model:

Morningstar: A leading provider of investment research, Morningstar licenses financial data and analysis to institutional investors, fund managers, and financial advisers.

Bloomberg: Bloomberg offers data-driven financial insights to clients, including real-time market data, financial news, and proprietary analytics tools, all available via subscription or licensing.

S&P Global Market Intelligence: S&P provides data-driven insights across various industries, offering licensed access to its analytics platforms, financial reports, and forecasts.

Benefits/Disadvantages:

Benefits:

Recurring revenue through licensing agreements with clients.

High value proposition, as financial insights are crucial for decision-making in investment and business strategy.

Scalable model as insights can be repackaged and sold to multiple clients.

Disadvantages:

High competition in the financial data space.

Difficult to establish trust and credibility for new players in the market.

Requires constant updates and maintenance to ensure the data remains relevant and accurate.

Execution:

Collect and analyze large volumes of financial data to extract actionable insights.

Package the insights into reports, forecasts, or proprietary tools.

License these products to third parties such as financial institutions, investors, or consultants.

Charge clients based on the scope of data, usage, or frequency of updates.

Practical Example:

Bloomberg Terminal: If a company licenses a Bloomberg Terminal for $2,000 per month, and a financial institution purchases 100 terminals, the total annual revenue would be $2.4 million.

4. Dynamic Membership Tiers Offering Customized Investment Packages (Membership Models)

What it is:

This model involves offering various membership tiers, where each tier grants access to increasingly valuable or personalized investment services. Clients pay for membership at different levels based on the complexity of the services they require. Each tier can include personalized investment advice, exclusive portfolio management services, or advanced financial tools.

Top Companies & Startups Adopting This Model:

Betterment: A robo-advisor offering multiple membership tiers that provide access to different levels of financial advice, from basic automated services to premium advisory services.

Wealthfront: Wealthfront provides tiered services for clients, offering basic portfolio management for lower fees, with higher levels offering more personalized financial planning.

Personal Capital: Personal Capital offers a tiered subscription model that provides basic financial tools for free, with premium services such as wealth management available at higher tiers.

Benefits/Disadvantages:

Benefits:

Flexible and scalable revenue model based on the customer’s needs.

Potential for high lifetime value from premium members.

Personalized services drive stronger client engagement and retention.

Disadvantages:

Complexity in designing and managing multiple tiers of service.

Risk of customer dissatisfaction if lower tiers feel they are missing out on key features.

Requires strong segmentation to ensure customers are placed into the correct tier.

Execution:

Create a tiered membership structure, with each tier offering different levels of service and benefits (e.g., automated investment advice at the base tier, personalized advisory services at the highest tier).

Charge clients a subscription or annual fee based on the tier they select.

Offer additional customization options for higher tiers, such as bespoke investment strategies.

Practical Example:

Betterment Membership: If Betterment charges $0.25% for assets under management (AUM) for the basic tier and 0.40% for premium advisory services, a customer with $500,000 in assets in the premium tier would pay $2,000 annually for advisory services.

5. Revenue Sharing Models with FinTech Apps for Integrated Services (Technology Industry)

What it is:

This model involves forming partnerships with fintech applications to provide integrated financial services. In exchange for offering their platform’s functionality, fintech companies share a portion of the revenue with asset managers, investment firms, or other service providers.

Top Companies & Startups Adopting This Model:

Plaid: Plaid connects applications to users’ bank accounts and financial data. They offer APIs that fintech apps integrate into their platforms, sharing revenue with financial services providers.

Robinhood: Robinhood allows other fintech apps and services to integrate into its platform, and it shares revenue from its customer base with those providers through referral fees or embedded financial products.

Stripe: Stripe facilitates financial transactions for digital platforms, and in exchange, it partners with fintech companies, offering them a share of the revenue generated by transaction fees.

Benefits/Disadvantages:

Benefits:

Revenue-sharing agreements provide financial services with a new revenue stream.

Scalable business model, as fintech apps grow, so does the revenue share.

Offers users access to a wider range of integrated financial services.

Disadvantages:

Dependence on the performance and user base of the fintech apps for revenue generation.

Potential for reduced margins if too many partners are involved in the revenue share.

Legal and regulatory challenges when dealing with revenue sharing in the financial sector.

Execution:

Partner with fintech apps that offer complementary services.

Integrate services through APIs or other technical solutions, offering customers enhanced features.

Set up a revenue-sharing agreement where fintech companies pay a percentage of the revenue generated through the platform.

Practical Example:

Plaid and Robinhood: Plaid integrates with Robinhood to provide users seamless access to their bank account for investment transactions. Plaid receives a fee for each transaction, sharing a portion of the fee with Robinhood for the access provided.

Key Metrics & Insights for Asset Management Business Revenue Models

1. Management Fees Based on Assets Under Management (AUM)

Key Metric: Assets Under Management (AUM)

What Is It: The total market value of assets that a firm manages on behalf of its clients.

Why It Matters: AUM directly affects revenue, as management fees are typically calculated as a percentage of AUM. Increasing AUM means increasing revenue.

Computation/Implementation:

Formula: Fee = (AUM) * (Fee Percentage)

If a firm manages $100 million and charges 1% annual fee, the fee would be $1 million.

Important Considerations: Growth in AUM requires attracting new clients and retaining current ones. Client portfolio performance impacts AUM and fee income.

2. Performance-Based Fees Tied to Investment Returns

Key Metric: Investment Return / Alpha

What Is It: The return generated by the investment compared to a benchmark or index. Performance fees are charged based on outperformance.

Why It Matters: Investors will be motivated to work with asset managers who generate returns above the benchmark. Performance fees can incentivize asset managers to perform better.

Computation/Implementation:

Formula: Fee = (Excess Return) * (Performance Fee Percentage)

If a fund's return exceeds the benchmark by 5%, and the performance fee is 20%, then the fee is 5% * 20%.

Important Considerations: High risk in performance fees can deter clients if their portfolios underperform. Balancing risk and return is key.

3. Subscription-Based Advisory Services for Individual Investors

Key Metric: Number of Subscribers

What Is It: The number of individual investors who pay a recurring fee for advisory services.

Why It Matters: Recurring revenue from subscriptions provides steady cash flow and scalability. Retention is critical to maintain subscription revenue.

Computation/Implementation:

Formula: Monthly Revenue = Number of Subscribers * Subscription Fee

Important Considerations: Providing high-value content or personalized advice increases retention. Subscription models are often priced tiered by service levels.

4. One-Time Consultation or Planning Fees

Key Metric: Number of Consultations / Fee per Consultation

What Is It: Revenue generated from one-time financial consultation sessions.

Why It Matters: This model allows asset managers to serve clients on a per-need basis, and the total revenue depends on the number of consultations.

Computation/Implementation:

Formula: Revenue = Number of Consultations * Fee per Consultation

Important Considerations: Clients may be more inclined to pay for one-time advice rather than long-term commitment, but the revenue can be volatile.

5. Retainer Fees for Ongoing Financial Planning Services

Key Metric: Retainer Clients

What Is It: Ongoing income from clients who pay a monthly or annual fee for continuous planning services.

Why It Matters: Retainer fees ensure predictable, recurring revenue. It’s a good indicator of long-term client commitment and satisfaction.

Computation/Implementation:

Formula: Annual Revenue = Retainer Fee * Number of Clients

Important Considerations: Client retention is key. Building strong relationships can lead to a steady revenue stream.

6. Revenue Sharing from Partnered Investment Platforms or Funds

Key Metric: Revenue Share Percentage / Investment Volume

What Is It: Income from partnering with investment platforms, where a portion of revenue is shared for referring clients or managing funds.

Why It Matters: This model provides additional revenue streams beyond direct management, increasing diversification.

Computation/Implementation:

Formula: Revenue Share = Total Investment * Share Percentage

Important Considerations: Establishing strong partnerships and a good reputation is crucial to maximize revenue sharing opportunities.

7. Licensing Proprietary Investment Tools or Models

Key Metric: Licensing Fees / Number of Licenses Sold

What Is It: Fees earned from licensing proprietary tools, models, or software to other asset managers or financial institutions.

Why It Matters: Licensing can generate passive income while scaling the business. This can open new revenue channels outside of client management.

Computation/Implementation:

Formula: Licensing Revenue = License Fee * Number of Licenses Sold

Important Considerations: Ensure that proprietary tools offer unique value to attract licensees. Protect intellectual property rights.

8. Revenue from Managed Accounts or Fund Structures

Key Metric: Fund Size / Number of Managed Accounts

What Is It: Revenue from managing separate accounts or fund structures for clients.

Why It Matters: Larger fund sizes or more managed accounts increase revenue. This is common in mutual funds or hedge funds.

Computation/Implementation:

Formula: Revenue = (AUM) * (Management Fee Percentage)

Important Considerations: Requires compliance with regulatory standards and a strong performance record to attract and retain investors.

9. Transaction Fees for Asset Buying, Selling, or Rebalancing

Key Metric: Transaction Volume / Fee per Transaction

What Is It: Fees earned for each transaction made (buying, selling, or rebalancing) within a portfolio.

Why It Matters: These fees create a continuous stream of income and align the asset manager’s interests with active portfolio management.

Computation/Implementation:

Formula: Revenue = Number of Transactions * Transaction Fee

Important Considerations: Transaction fees should be structured in a way that encourages efficient trading while still being profitable.

10. Educational Revenue from Financial Literacy Courses or Webinars

Key Metric: Course Enrollment / Webinar Participation

What Is It: Income generated from offering financial literacy resources, courses, or webinars to individuals or businesses.

Why It Matters: Educating clients and prospects can enhance brand loyalty while generating revenue. It also positions the firm as an expert in the industry.

Computation/Implementation:

Formula: Revenue = Enrollment Fee * Number of Participants

Important Considerations: Content must be high quality, and marketing must effectively target individuals seeking financial education.

Comments